Post Covid-19 Life

Post Covid-19 life could give rise to a new era of human development. Otherwise, economic and social development may falter for decades. Covid-19 could do for the biomedical industry What the Y2K scare did for the Indian IT sector

The Gita (like the Upanishads)is not a mere religious text in the conventional sense of the term. It is an in-depth study

of the nature of consciousness and a practical guide to exploring its depths. Above all, it is an exhortation to shake off

negativity and depression, the inner enemies, and fight the outer enemy depicted as the epitome of evil, degradation, and destruction.

Click here for How to move towards economic recovery –

We are now (globally) living through the most uncertain moment of our times. Many countries have been in lockdown since early March 2020. Even Japan, once a beacon of hope for controlling COVID-19, is now moving toward total isolation.

Many political leaders realize that physical distancing might be the norm for at least several months. They wonder how—or if—they can maintain indefinite lockdowns without compromising the livelihoods of their people.

Political leaders aren’t alone in their fears. As the pandemic continues its exponential course, workers in most countries wonder what will become of their jobs when the lockdowns end.

Businesses struggling to pay their employees and cover operational costs wonder if they will have clients or customers when they reopen. Banks and investors realize that many companies, especially small and midsize ones, will default and are trying to protect both financial stability and public savings.

Meanwhile, governments are working to calculate the magnitude of the shock and sharpening their tools to save economies from collapse. They know that history will judge them by the decisions they make now.

This daunting scenario poses several basic questions. How can we save both lives and livelihoods? Which decisions are best managed by governments?

How can they evaluate the risks that experts predict from a prolonged lockdown, such as starvation, domestic violence, and chronic depression—as well as protect jobs, income security, food supplies, and the general welfare of the most vulnerable people among us?

How and to what extent should they try to save banks, prevent fiscal ruin, and safeguard future generations?

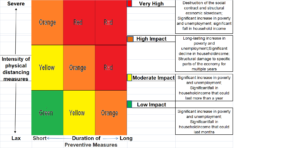

Governments could address all these questions strategically. In effect, they are caring for two patients who react to the same medicine—physical distancing—in very different ways. The first patient is the public-health system.

Physical distancing might cure or alleviate its symptoms but could exacerbate those of the second patient, the economy. This trade-off suggests a physical-distancing strategy for governments: ensuring the health system’s ability to deal with COVID-19 and protecting the economy.

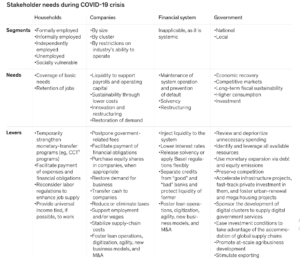

Table 1 shows how different levels of physical isolation affect economic conditions. A recession could occur if faltering demand, restricted supply, and lost income reach critical levels.

The differences between scenarios could be tenfold: a country that applies physical distancing in a lax way and ends it too soon could face zero GDP growth, but if the same country imposed a very strict and prolonged quarantine, GDP might plunge by 20 percent. In some Western economies, the latter scenario might increase government control of strategic sectors.

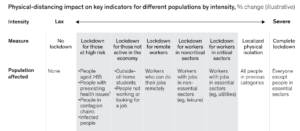

Physical distancing could affect the workforce profoundly

Impact of prolonged distancing on livelihoods

Refer Table-1

Countries can avoid the worst scenarios if they work quickly along three principal lines of action :

- first, minimizing the impact of physical distancing on the economy;

- second, spending deeply to keep it afloat; and

- third, spending even more to accelerate the crisis recovery and to close historical gaps.

Minimize the economic impact of physical distancing

Recently we have observed how different isolation strategies can have different effects on the ability of countries to save both lives and livelihoods. Policies for localized physical distancing at the regional, sectoral, or individual level might have better results than blanket lockdowns of entire countries.

The time has, therefore, come to quantify the impact of lockdowns on people’s livelihoods.

Advanced analytics could help countries estimate—with a high level of confidence—the shock to the economy by aggregating data on power consumption, debit- and credit-card spending, applications for unemployment insurance, default rates, and tax collections.

Individual countries that implement localized physical distancing might be able to keep track of how many people are in the streets at any given time and how much economic activity those people generate.

But approaches to physical distancing will probably vary a good deal from country to country, depending on how they balance public-health issues with privacy concerns. Countries could plan prolonged lockdowns for the elderly and children and estimate their levels of consumption.

They could quantify the number of employees in essential sectors that continue to operate (health, security, food and beverages, agriculture, utilities, and transportation). They could determine which regions or states should remain under complete lockdown and which sectors are operating under strict health protocols in other places.

And they could track how many people are working from home in each sector and their contributions to the economy.

Analyzing a granular level of information might help countries quantify the weekly impact of physical distancing on various key indicators by region and by the economic sector.

This granular level of information might help countries quantify the weekly impact of physical distancing on GDP, productivity, aggregated demand, income loss, unemployment, poverty, and fiscal-deficit levels by region and by the economic sector. If countries knew all that information, they would know the cost of the lockdowns on the livelihoods of their people.

Refer Table -2

Spend deeply to keep the economy afloat

Armed with information on the economic impact of physical-distancing strategies, governments can prepare their next moves.

Refer Table-3

To recover from the pandemic’s health and economic consequences, we must uphold the social contract—the implicit relationship between individuals and institutions.

The market economy and the social fabric that holds it together will be deeply compromised, or perhaps undermined, if massive numbers of jobs are lost, vendors can’t fulfill their contracts, tenants can’t make their rent, borrowers default at scale, and taxes go unpaid.

Governments could, therefore, quantify the minimum level of income that households need to cover their basic necessities, the minimum level of liquidity that companies need to cover their costs (including payrolls) and to protect their long-term solvency, the minimum liquidity levels that banks need to support defaults, and the minimum amount of money that governments need to supply all those requirements. Let’s examine each of them.

Formal, informal, or independent workers will all have their own particular financial needs. So will vulnerable populations, such as people at higher risk of infection, which might not be able to return to work for some time.

Leaders in the public sector should determine the level of support that each population segment requires and the appropriate distribution channels for fast delivery.

Janani Suraksha Yojana (JSY) in India, for example, are conditional-cash-transfer (CCT) programs that support millions of vulnerable people. Such programs could temporarily expand to cover other segments of the population, such as informal and independent workers. It might also be necessary to consolidate databases and information systems and to digitize all payments.

Since revenues have plummeted, many companies require help to safeguard employment.

Their needs vary widely among sectors of the economy; professional-service firms, for example, usually have twice as many working-capital days as restaurants do. What’s more, physical distancing will affect different kinds of companies in different ways.

As a first move to help them, several countries have already frozen short-term fiscal, parafiscal, and social security payments. Some are using innovative instruments to irrigate money—for instance, capitalizing national reinsurance agencies to cover most of the expected losses from the new loans required to bridge payroll payments and working capital.

Banks can play a meaningful role during the crisis in two fundamental ways: lending money to companies in distress and recognizing that some companies simply can’t survive.

If default rates on current loan portfolios skyrocket, the expected shock to incomes and to supply and demand could compromise the solvency of some banking systems.

Besides thinking about loosening solvency and warranty regulations, governments might consider creative solutions, such as distinguishing among banks according to their credit portfolios to strengthen financial institutions’ balance sheets and injecting government-backed convertible loans against their long-term warrants and restructuring targets.

Governments implemented these mechanisms successfully in other financial emergencies, such as the 1997 Asian market crisis, the 1999 Latin American crisis, and, most recently, the 2008 crisis in Europe and the United States.

Strengthening the balance sheets of banks might not be enough to deal with the aftermath of COVID-19; governments might have to use monetary expansion through debt and equity emissions backed by central banks.

Countries with deeper capital markets could not only securitize loans and new instruments but also use the financial strength and long-term view of pension funds and other institutional investors to ease short-term crisis-related pressures on public finance.

Governments shouldn’t be shy about using such instruments extensively if that’s needed to keep economies running. Since such stimuli would have a cost, additional fiscal requirements could complement them in the medium term.

To preserve national solvency, governments might also re-examine historical exemptions from taxation.

Spend more to accelerate the crisis recovery and close historical gaps

After countries estimate the size of the stimulus packages (like India has announced) needed to help households, companies, and financial systems, they can start designing additional, customized programs to restore demand and accelerate recovery.

People who receive direct subsidies to stay at home could gradually return to work as each sector of the economy introduced new health and behavioral practices.

Meanwhile, as many workers as possible should receive new job opportunities. To provide them, governments could introduce innovative labor regulations and help companies operate 24/7 under flexible schemes.

They might also turn old-fashioned CCT programs into universal-income alternatives linked to new jobs in ambitious, government-led programs for infrastructure, housing, and industrial reconversion.

Governments may also find it advisable to relax their regulatory regimes to help businesses not only reopen but also grow. Most countries have national, local, and sectoral regulations that were perfectly appropriate before the coming of COVID-19 but will be extremely expensive in the next normal.

National programs to eliminate red tape at scale will help a good deal. Speed and flexibility are essential.

Businesses in sectors facing strict physical-distancing policies might need additional long-term capital. Governments could use innovative special-purpose vehicles to inject fresh equity and provide fiscal incentives to attract long-term investors.

Businesses receiving that sort of aid should expect to commit themselves to restructure: rescue packages could promote leaner operations, digital and industrial reconversions, the introduction of new channels, agile organizational structures, and innovative learning techniques.

Governments could also ensure that such aid programs encourage competition—poorly designed policies that strengthen oligopolies and threaten the interests of consumers will be costly in the long run.

Although governments should carefully weigh the impact of their aggressive programs against long-term fiscal sustainability, they can play a significant role in restoring demand for goods and services and in fostering investment in new business models.

Many initiatives post covid-19 life—

- accelerating infrastructure projects;

- fast-tracking private investment to build hospitals, schools, and other social projects;

- encouraging urban renewal and very large housing projects; sponsoring the development of digital clusters to digitize government services;

- easing investment conditions to take advantage of global supply chains; capturing near-shore production opportunities;

- promoting large agribusiness developments, and stimulating exporting—could promote those goals. It is time to spend—but wisely.

The COVID-19 pandemic is a global tragedy. But that shouldn’t—and needn’t—prevent us from finding innovative ways to accelerate progress. It would not be the first disaster to do so.

This may be the right time to introduce fiscal, labor, pension, social, environmental, and economic reforms to speed up progress toward sustainable development.

Ameliorating poverty, diminishing inequality, and protecting the environment could figure prominently in global and national agendas.

Governments, companies, and social organizations could act quickly to promote full financial inclusion, the transition to cashless economies, and the provision of better and more efficient social and public services.

Political leaders might condition access to massive economic-stimulus programs on efforts to reduce informality, rethink healthcare systems, digitize entire sectors of the economy to accelerate productivity, and encourage digital innovation—especially high-quality public education with universal internet access.

Governments ought to act quickly. The first step is to understand the economic impact of the crisis in both the short and medium terms. Second, governments could inject the minimum viable liquidity to keep markets alive.

Finally, they could expedite ambitious fiscal and monetary policies to accelerate recovery. In most economies and markets—national and international alike—ratios of debt to GDP will likely rise.

Confidence that tax frameworks will gradually support next-normal debt levels will be necessary.

Once the pandemic ends, countries around the world will probably find themselves more in debt than ever. If they restructure and innovate, attract investment, and increase their productivity, a new era of human development will begin.

But if they spend haphazardly and imprudently, economic and social development might falter for decades to come. The societies, governments, institutions, companies, and people of the Earth now face basic choices. Let’s hope they think about them seriously.

Table-1

![]()

Table-2

![]()

Table-3

![]()

Click here for India Inc chalks out Plans after Covid-19 –

India Inc has started preparing for life after the lockdown by chalking out Covid-19 risk mitigation plans including social distancing, remote working, and even temporary succession planning to ensure business survival even as the pandemic remains a clear and present danger.

Wearing masks, isolated workspaces and remote working will be a norm when the lockdown eases up and corporates try to return to normalcy.

Companies will have to strictly follow guidelines to ensure that employees are safe and business risks can be minimized, said the president of the industry association Federation of Indian Chambers of Commerce and Industry (Ficci). “Employees, too, have to be proactive and compliance issues should be followed strictly”.

No casual attitude (in terms of social distancing) should be tolerated.

The Ficci advisory said organizations need to “communicate with employees frequently and with the right specificity to keep the workplaces prepared for infection prevention and ensure the health and safety of employees.

Ficci has chalked out multiple scenarios of how the Covid-19 can evolve and issued guidelines and advisories to corporates on ways to tackle various challenges at the workplace. “Prepare temporary succession plans for key executive positions and critical roles and analyze if there is any high-risk work or any paper-based processes or processes that cannot be easily moved online and need a separate work plan,” it said.

Following rules will be followed by all corporates-

- A detailed planning activity, where we need to identify which employees really need to come to work, even after the lockdown is lifted. Others can continue to work from home. That clarity is important.

- Companies should ensure transportation for their workers. At the offices, there should be a series of checkpoints testing that can be done. There should be holding areas for colleagues to ensure that a red flag can be raised if someone’s feeling unwell.

- We have to ensure there is no crowding in our office spaces, ensure that only 25 or 50% of the workspace is actually occupied.

- A similar set of actions needs to be done with our support staff including security guards, receptionists, cafeteria staff. We have to ask if we really need all of them to come into work in the beginning or come in a staggered manner.

- These have to be well thought out efforts to ensure that while we open up our offices, we take every step possible to minimize the impact on employees and ensure their well being and safety.

- Arrange transport, from the staff member’s house to the office. The vehicles were sanitized; the drivers were tested before they picked them up.

- Arrange paramedics to check every single person in the workplace twice a day.

- Schedule shift duties in such a way that the same person doesn’t stay in office for a long period of time. So let there be five-hour rotational shifts.

- Outsource the company to sanitize the office.

- Try to make washing of hands fun and a way of life rather than a chore.

- Support staff may not understand normal communication. So come up with exercising communication that is easy to understand, that also explained to them the importance of simple things like washing hands, wearing masks, Etc.,

- Be compassionate. Don’t force the people to come to work but make it a voluntary system. Ask staff who are willing to come to work and if someone refuses to respect his decision. Understand it is not that person who is scared but the whole ecosystem at the back end around the individual, which consists of their family.

These families could consist of very young children, very old parents, etc. Then there is a larger ecosystem with the building or the society they live in.

If possible create accommodation for our staff, for those who are staying far away, close to the place of work so that they don’t have to go back home and antagonize family or neighbors in that process. These measures, no doubt, are capital intensive, but necessary.

- Here certain things are non-negotiable. So every organization irrespective of its size will have to do testing, sanitizing of the workplace, have a doctor available. There will be other elements that are easier for a smaller company but pose significant challenges for a large company. This can include transportation. Larger organizations won’t be able to take control of the commute or put people in guest houses or other accommodation. That will put a significant financial strain on a lot of organizations. So there will be a reduction in the pace of operations. The focus has to be on enabling work from home, wherever possible so that it’s just a proportion of the employees that are impacted. Even when the lockdown is opened not everyone will be allowed into an office at the same time. Create rosters where teams come in at certain times during the day complete their work, and leave. So all of those will have to be taken into consideration and planned out so that we are able to organizations can be managed with minimum cost and maximum care.

Click here for Steps required post control on Covid-19 –

“It’s going to be step by step, there is going to be some trial and error, this is completely uncharted territory. No country in the world has worked this out yet … Globally everyone will have to work together and a way through.”

There are timelines: in four weeks, the national cabinet of the state and federal governments will reevaluate lockdown measures to see if any can be relaxed or lifted; in six months, the government hopes that the extraordinary financial architecture inserted to prop up the country’s economy can start to be wound back. But social distancing may last for years until a vaccine is found or widespread community immunity is achieved.

Critically, however, the country’s immediate road map should be more definitive on what, rather than when.

Three conditions for easing restrictions

The following points can be outlined as three key criteria that will guide the path back from Covid-19.

- An increased capacity to test and a more extensive “sentinel testing” regime, which means testing rapidly and widely, including people who are asymptomatic, to understand just how widespread the virus is.

- Contact tracing “lifted to an industrial capability”, to find and isolate all of the contacts of known infection. A key part of this will be encouraging all to download to their phones a tracing app, currently in production, modeled on like Aarogya Setu in India, which uses BlueTooth to alert users when they come into contact with a confirmed case.

- Strengthened “local response capabilities” – essentially the ability to lock down hotspots where outbreaks occur, such as the one in Mumbai, Maharashtra. This will include multiple layers of government agencies, including, potentially, the military.

For countries that have weathered the Covid-19 storm well so far,

- the pressure on governments to reopen their societies and economies is intense: from business groups seeing entire industries laid barren;

- from political commentators reading the economic data and seeing a sea of red; from families anxious to see children back in school;

- from citizenry desperate to get back to work and reestablish some normality in their lives.

But the risks of relaxing too much, too soon, are very real, and medical experts have warned against rushing to lift restrictions prematurely, potentially sparking a more deadly second wave and undermining the hard-won gains so far.

Life under level three will still be tightly proscribed; contact with other people must still stay “very very limited”. But the number of people back at work will roughly double under level three, with the exemption on workplaces relaxed from “essential” to “safe”.

Early childhood centers and schools will reopen for students up to year 10 under level three, but attendance would remain voluntary. Funerals and weddings with up to 20 people would be allowed under the relaxed regime. Electricians and plumbers can go back to work but must keep their distance from customers.

Cafes, restaurants, malls, and retail shops must stay closed but food delivery, drive-through services, and online shopping will be allowed.

Practical Steps –

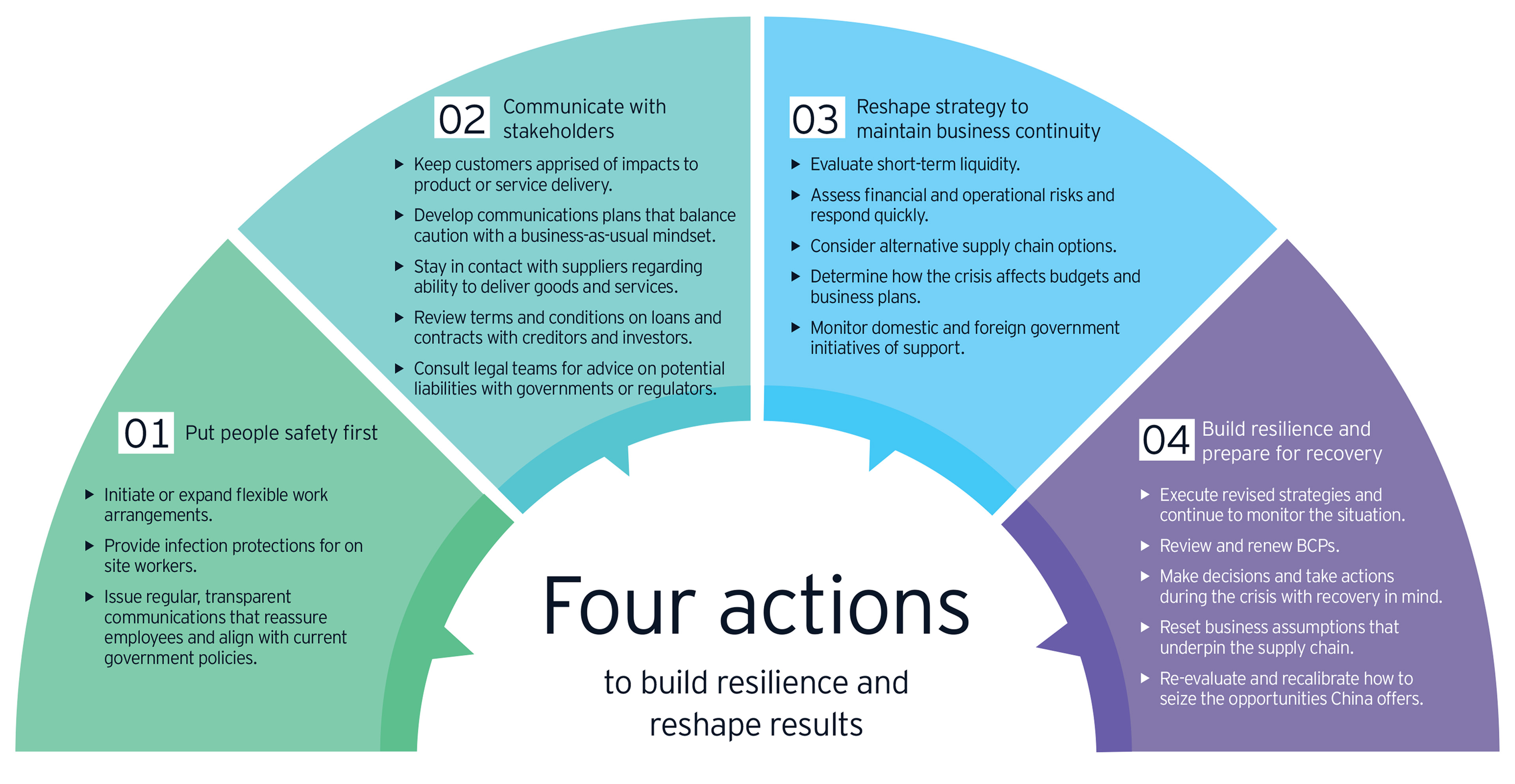

Global companies have to be predictive and proactive in their decision-making to preserve business continuity and build enterprise resilience.

As companies navigate the ongoing COVID-19 crisis, there are a number of key issues corporate leaders should be thinking about, as well as steps they can take to not only react to severe business shocks now but also reshape their business and plan for recovery.

We have identified five priorities for business leaders to consider – many based on perspectives and experiences from India and other countries in Asia, where COVID-19 impacted.

1. Prioritize people safety and continuous engagement

Ensuring the safety and wellbeing of the employees in the workplace is essential. People are looking at their employer, community, and government leaders for guidance. Addressing their concerns in an open and transparent manner will go a long way to engaging them and reassuring business continuity.

One of the adjustments companies have to make is to initiate or expand flexible work arrangements and other policies that allow people to work remotely (from home) and safely. Depending on the sector, companies will want to reorganize teams and reallocate resources and establish employee wellbeing programs and policies that support a safe working environment. Additionally, companies will want to produce regular communications that align with the current government and health authorities’ policies to help employees remain engaged as they and the organization navigate through the crisis.

Finding ways to reimagine a business-as-usual environment that minimizes disruptions for the organization requires a fine balance. Where telecommuting or flexible work arrangements aren’t possible and companies must have workers on-site or in direct contact with customers, it is important to provide infection protection measures.

To help companies provide safe work environments, some municipal governments are working with big data amassed by technology companies and mobile operators to develop a health QR code system that allows people to track their movements over the previous 14 days to prove that they haven’t visited any high-risk areas. Still, other governments centrally and locally are exempting or deferring, in part or in full, social insurance and rental payments.

Even with all these measures, there will be businesses that will experience workforce disruptions. Labor shortages and increased costs due to mobility restrictions that various state and local government authorities have imposed will impact businesses and also due to migrants moving to their home town. Companies that experience unique challenges, not covered by specific policies already issued, should seek advice from their local governments (like district Collector). Many governments have introduced fiscal stimulus and assistance programs for small businesses and sectors such as tourism and hospitality which have been severely impacted. Indian Government has announced a stimulus almost for all sectors of about 265 Billion Dollars.

2. Reshape strategy for business continuity

Most businesses are likely to experience significant disruption to their business-as-usual operations and will face business underperformance throughout the duration of the COVID-19 crisis. At the start of this crisis, supply chain challenges were significant for companies with exposure to China. But now the crisis has spread to Europe and the U.S, many more companies are experiencing operational disruption, as well as significant shifts in consumer demands and behavior impacting sectors from consumer and retail, to manufacturing, life sciences to automotive.

To help address these challenges, companies should:

- Evaluate short-term liquidity. Companies will want to instill the short-term cash flow monitoring discipline that allows them to predict cash flow pressures and intervene in a timely manner. They’ll also want to maintain strict discipline on working capital, particularly around collecting receivables and managing inventory build-up. Additionally, it’s important to be creative and proactively intervene to lighten the working capital cycle. Throughout the crisis, companies will want to maintain regular contact with suppliers to identify any potential risks.

- Assess financial and operational risks and respond quickly. Companies will need to monitor direct cost escalations and their impact on overall product margins, intervening and renegotiating, where necessary. Companies that are slow to react or unable to renegotiate new terms and conditions may be vulnerable to the financial stress that could carry long-term implications.

Just as companies need to monitor their in-house vulnerabilities, they also will need to monitor the pressures that may be impacting some of their customers, suppliers, contractors, or alliance partners. In particular, companies will want to stress test any tier one and tier two suppliers that may be impacted.

This is especially important for sectors such as automotive and pharmaceutical, which are highly dependent on third-party suppliers. Finally, be aware of covenant breaches with banking facilities and other financial institutions relating to impairment risks in asset values, which may impact the health of the overall balance sheet.

- Consider alternative supply chain options. Companies that source parts or materials from suppliers in areas significantly impacted by COVID-19 will want to look for alternatives. For example, a Japanese industrials manufacturer is considering moving the assembly of commercial air conditioners to Malaysia from the Hubei Province capital of Wuhan, which remains under lockdown. Similarly, a global apparel company is looking to move production of its products from facilities in Wuhan to Vietnam and Indonesia. Such quick moves will create a temporary capacity to meet customer obligations. Companies that have arrangements with agile manufacturing facilities to make spot buying decisions, or have loose contractual arrangements with various service providers and logistics providers, should consider the initial disruption as well as post-crisis scenarios given the potential for demand spikes.

- Determine how the COVID-19 crisis affects budgets and business plans. Companies will want to stress-test financial plans for multiple scenarios to understand the potential impact on financial performance and assess how long the impact may continue.

If the impact is material and former budget assumptions and business plans are no longer relevant, companies should revise them to remain agile. Where the business is significantly impacted, companies will need to consider minimum operating requirements, including key dependencies of the workforce, vendors, location, and technology.

There is also the issue of short-term capital demands for continuous business operations. Based on the outcome of the assessment, companies may need to look at near-term capital raising, debt refinancing or additional credit support from banks or investors, or policy supports from the government. At the same time, companies will need to review overall operating costs and consider slowing down or curtailing all non-essential expenses.

Communicate with relevant stakeholders

Clear, transparent, and timely communications are necessary when creating a platform to reshape the business and to secure ongoing support from customers, employees, suppliers, creditors, investors, and regulatory authorities.

- Companies will want to keep customers apprised of any impacts on product or service delivery. If contractual obligations cannot be met as a result of supplier or production disruption, it is important to maintain open lines of communication to revisit timelines or invoke “force majeure” or “act of God” clauses. Such proactive action will help to mitigate punitive damages or liabilities associated with disrupted customer obligations.

- For employees, communications plans should try to find a balance between caution and maintaining a business-as-usual mindset.

- Companies need to maintain regular contact with suppliers regarding their capability to deliver goods and services during the COVID-19 crisis and their recovery plans so that the company can consider alternative supply chain options in a timely manner.

- Creditors and investors. Companies will want to review terms and conditions on loan contracts to identify sensitive debts and avoid vital technical debt breaches. These reviews will have the added benefit of giving companies a chance to proactively manage the dialogue and communications with creditors regarding any necessary amendments to existing terms or refinancing arrangements.

- Government and regulators. When communicating with relevant stakeholders, companies will want to consult with their legal teams for advice on potential liabilities and with their business units regarding how to manage communications around ongoing breaches and collection of proof, if any.

Companies have to ask themselves whether they have the right supply chain and agility to withstand a three-month disruption.

4. Maximize the use of government support policies

The government of India has released several financial, social insurance, and tax-related policies to support companies. Recently the US, UK, and many other developed nations have announced amendments to tax and financing policies.

Companies should monitor nation-wide government and organizational opportunities for support and how they may best serve the individual circumstances of their situation. It is important to note that government support may differ based on jurisdiction and sector. Companies will need to identify and understand each offer of support and determine which ones are best for their organization.

Finance Minister of India has published a series of policies to provide support for preventing and treating the epidemic, including:

- Exempting and refunding value-added tax (VAT) for enterprises providing certain services for epidemic control or manufacturing key epidemic-related necessities.

- Offering a full corporate income tax (CIT) deduction for purchasing equipment to manufacture epidemic prevention-related supplies.

- Providing an individual income tax (IIT) exemptions on bonuses and allowances relevant personnel receive for treating the epidemic.

- Issuing other policies that encourage public-benefit donations.

Temporary social insurance contribution deductions and exemptions the STA and Ministry of Finance (MOF) have introduced also have helped to ease the burden on companies.

Other countries impacted by the crisis, including Singapore and Japan, are introducing similar government policies. Companies should monitor the availability of these kinds of programs and use them to mitigate the risks they face.

5. Build resilience in preparation for the new normal

Once companies have solidified strategies based on stress tests and communicated any new directions with relevant stakeholders, they will need to execute based on revised plans while monitoring what continues to be a fluid situation. Senior management should report any material deviation from the plan in a timely manner so that their companies can take additional action to avoid further negative impact.

Once the COVID-19 outbreak is controlled, companies will want to review and renew business continuity plans (BCP). They’ll want to assess how existing BCPs are working. If there are deficiencies, companies will want to identify root causes, whether it’s the timeliness of action, lack of infrastructure, labor shortages, or external environmental issues. Companies will then want to consider putting new internal guidelines in place based on lessons learned, as well as solid contingency plans to build resilience and better respond to future crises.

Financial services organizations have an ethical opportunity to develop more agile products for working capital and short-term loans to support the economy.

Plan for recovery now, not later

The COVID-19 crisis was impossible to predict with conventional wisdom and forecasting tools. However, there are many lessons companies can learn and carry forward once the crisis has passed and they’ve had a chance to analyze their response.

In the meantime, companies should be making decisions and taking actions during the crisis with recovery in mind. When the crisis is over, it will be clear which companies have the resilience and agility to reshape their business strategy to thrive in the future.

Longer-term, companies will need to consider how robust their business, management team, and initiatives were in facing the crisis. It will also be important to consider and reset the business assumptions that underpin the supply chain and other concentrations that many businesses have been exposed to overtime.

Once the situation is mitigated, companies should reevaluate how robust their business management was facing the crisis, and then analyze options to become more resilient against future disruptions.